Still scratching your head trying to figure out why your tax return was so much smaller, or why you even may have, *gasp*, owed? Since the U.S. education systems fails miserably in teaching us all about taxes and how the system works, we’re going to break it all down for you in our new blog post series- Taxes 101. In our first post in this series, we’re going to start with some terms and definitions that will help make the other posts easier to understand.

Glossary

Filing Status– there are five separate filing statuses. In part, your filing status (along with your income) helps to determine your tax bracket.

- Single– This status normally applies if you aren’t married. It also applies if you are divorced or legally separated under state law.

- Married Filing Jointly– If you’re married, you and your spouse can file a joint tax return. If your spouse died during the year you are filing, you can often file a joint return for that year (i.e. your spouse died in 2018, you can file a joint return for 2018).

- Married Filing Separately– A married couple can choose to file two separate tax returns. This may benefit you if it results in less tax owed than if you file a joint tax return. You may want to prepare your taxes both ways before you choose. You can also use it if you want to be responsible only for your own tax.

- Head of Household– In most cases, this status applies if you are not married, but there are some special rules. For example, you must have paid more than half the cost of keeping up a home for yourself and a qualifying person. Don’t choose this status by mistake. Be sure to check all the rules. And if you’re unsure, the tax experts at My Numbers Guy are always happy to help 🙂

- Qualifying Widow(er) with Dependent Child– This status may apply to you if your spouse died recently and you have a dependent child. Other conditions may also apply. Again, unsure? Drop us a line and we’ll help you out!

Standard Deduction– This is the amount you get to deduct from your income solely for existing as a person. In 2017, this amount was $6,350 for a single person or married person filing separately ($12,700 for married couples). In 2018, this amount practically doubled to $12,000 for a single or married person filing separately ($24,000 for married couples).

Adjusted gross income (AGI)– Your total income, before taxes, but after certain allowed deductions, like the standard deduction.

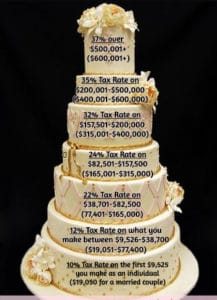

Tax bracket– Bands of taxable income that have different tax rates. Think of this like a 7 tiered cake. Working from the bottom of the cake as the first tier, you are taxed the least on that tier of income, or, you get to keep the most of the biggest tier. On the second tier of income, you are taxed at a slightly higher rate, and so on. Check out our handy little visual below! (Based on 2018 tax rates.)

**These brackets change from year to year.**

Deduction– Amounts you are allowed to deduct from your gross income and will lower your taxable income (i.e. you make $50,000 and take the standard deduction, $12,000, making your taxable income $38,000)

Credit– Reduces your tax liability (i.e. what you owe, for example- $15,000 in taxes, but you qualify for the child tax credit, which is $2,000, so now you owe $13,000).

Is your head spinning yet? Don’t worry if it is! Feel free to drop any questions below or reach out to us via email, Facebook, or the good ol’ fashioned telephone (484.544.3755). Have a term you think we should add? Don’t hold out on us! Let us know that too!!

Check back soon for our next post in the Taxes 101 series- Deductions: Standard vs. Itemized!

Recent Comments